The U.S. Securities and Exchange Commission (SEC) regulator approved the U.S.-listed exchange-traded funds (ETFs) that make the cryptocurrency realm explosive. Amidst this, numerous investors express keen interest in acquiring Bitcoin ETFs. Consequently, the question arises: Where Can I Buy Bitcoin ETFs in 2024?

Where Can I Buy Bitcoin ETFs?

Bitcoin ETFs are available through most online brokers who offer traditional securities like stocks and bonds. Among these brokers, some facilitate direct investment in Bitcoin, while others only allow you to trade Bitcoin futures.

ETFs are actively traded on established traditional exchanges like the New York Stock Exchange or the Nasdaq. Should you have an interest in accessing a comprehensive array of cryptocurrencies and wish to engage in direct investments in digital assets, you’ll need an account with a crypto exchange, such as Binance or Kraken, but these exchanges find themselves in the regulatory crosshairs of the SEC.

Things You Must Know Before Buying Bitcoin ETFs

- Fee Analysis: When selecting spot Bitcoin ETFs, it is crucial for investors to carefully analyze the associated fees. Many issuers are currently providing fee waivers as an incentive to attract investments. However, it’s essential to recognize that these fee waivers offered by platforms are competitive and temporary.

- Management Fees Consideration: Another important factor to consider is the management fees associated with Bitcoin ETFs. High management fees, such as the 1.50% charged by Grayscale, can significantly impact the profits gained from the ETF. Investors are advised to target funds with annual management fees falling within the range of 0.2% to 0.5%. This consideration ensures that a substantial portion of the investment returns is not consumed by management fees.

Top 10 Bitcoin ETFs

Below is a list of the approved ETFs and their fees:

| ETF name & symbol | Fee | Notes |

| Franklin Templeton Digital Holdings Trust (EZBC) | 0.19% | N/A. |

| Bitwise Bitcoin ETF (BITB) | 0.20% | Fee exemption applies for the initial six months of trading or until the fund assets reach the first $1 billion, whichever occurs earlier. |

| Ark 21Shares Bitcoin ETF (ARKB) | 0.21% | Fee exemption applies for the initial six months of trading or until the fund assets reach the first $1 billion, whichever occurs earlier. |

| iShares Bitcoin Trust (IBIT) | 0.25% | Fee exemption applies for the initial six months of trading or until the fund assets reach the first $1 billion, whichever occurs earlier. |

| VanEck Bitcoin Trust (HODL) | 0.25% | N/A. |

| Fidelity Wise Origin Bitcoin Fund (FBTC) | 0.25% | Fee waived until Aug. 1, 2024. |

| WisdomTree Bitcoin Fund (BTCW) | 0.25% | Fee exemption applies for the initial six months of trading or until the fund assets reach the first $1 billion, whichever occurs earlier. |

| Invesco Galaxy Bitcoin ETF (BTCO) | 0.25% | Fee exemption applies for the initial six months of trading or until the fund assets reach the first $1 billion, whichever occurs earlier. |

| Valkyrie Bitcoin Fund (BRRR) | 0.25% | N/A. |

| Grayscale Bitcoin Trust (GBTC) | 1.50% | N/A. |

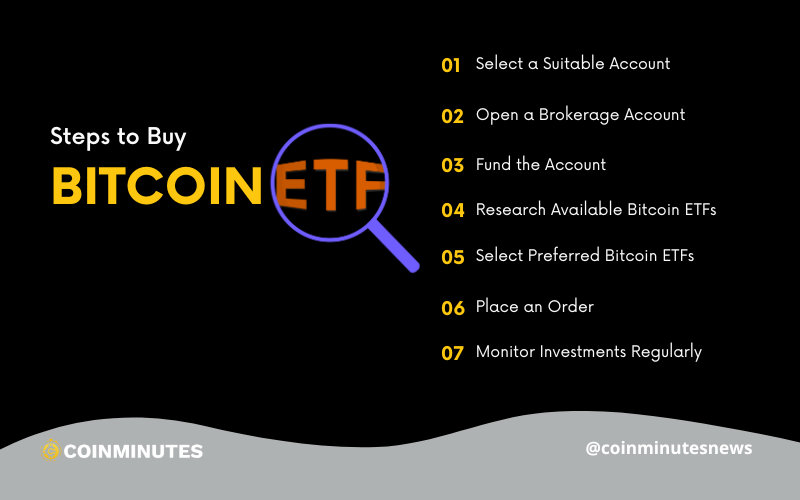

Steps to Buy in Bitcoin ETFs

- Select a Suitable Account: Begin by choosing a suitable account from the options mentioned earlier, and most of these accounts can be opened in 30 minutes or less. The account creation process is straightforward and typically completed online.

- Open a Brokerage Account: Choose a company that offers Bitcoin ETFs and proceed to open an online brokerage account.

- Fund the Account: Many brokerage platforms allow you to fund your account from other brokerage platforms or a regular bank account. Ensure that the account is funded adequately to cover the cost of your ETF shares, additional fees, and commissions.

- Research Available Bitcoin ETFs: Currently, there are 11 Bitcoin ETFs approved by the SEC. During your research, focus on ETFs with high trading volumes and substantial assets under management (AUM). Additionally, examine the composition of other assets within the ETF and verify the reputation of the issuer.

- Select Preferred Bitcoin ETFs: Your brokerage platform will likely offer at least two or three options, each with different fee structures. Choose a Bitcoin ETF that aligns with your budget and investment goals.

- Place an Order: Place a buy order for your chosen Bitcoin ETF, similar to the process for buying stocks. You can opt for a market order, which buys the ETF quickly, or a limit order, which executes at your pre-set price.

- Monitor Investments Regularly: Keep a close eye on your investment. Regularly check Bitcoin charts and stay informed about any news related to Bitcoin, as such information can impact the volatility of your Bitcoin ETF.

Conclusion

To summarize, CoinMinutes has answered your inquiry about where to purchase Bitcoin ETFs in 2024. As you delve into the realm of Bitcoin ETFs, it is important to conduct thorough research, make wise choices, and stay vigilant in monitoring your investments.