The cryptocurrency market is showing signs of thawing following a series of positive developments, notably the potential approval of a Bitcoin Futures ETF by the U.S. Securities and Exchange Commission (SEC). Since its inception, this innovative investment tool has garnered significant attention and discussion in financial markets, as it offers a more accessible and regulated way for both retail and institutional investors to participate in the crypto space.

So, What is a Bitcoin ETF? Let’s find out with CoinMinutex through the article below.

What Is a Bitcoin ETF?

A Bitcoin exchange-traded fund (ETF) is like a team of investors putting money together to buy contracts tied to the future price of Bitcoin. These contracts are agreements to buy or sell Bitcoin at a set price later on. The ETF is managed by a company and is listed on a regular stock exchange.

The main idea behind Bitcoin ETFs is to make it easier for people to invest in cryptocurrencies, especially for those who find it tricky to invest directly in these digital assets without actually owning them.

Bitcoin ETFs work kind of like regular investment funds, and their value goes up and down based on how the price of Bitcoin is doing. So, if Bitcoin’s value goes up, the ETF’s value goes up too, and if Bitcoin’s value drops, so does the ETF’s value.

When people talk about Bitcoin ETFs, some might think they’re backed by actual Bitcoin held in a digital wallet. But in reality, there are two main types of Bitcoin ETFs: ones that deal with spot Bitcoin and ones that involve contracts for future Bitcoin.

Right now, Bitcoin ETFs can only deal with contracts tied to the future price of Bitcoin. But if you’re interested in investing in companies connected to Bitcoin or blockchain technology, some funds track those too.

While there aren’t many Bitcoin ETFs available in the U.S. yet, other places like Canada and Europe have approved more of them. This makes it simpler for a wider range of people to join in on investing in Bitcoin without directly owning it, and it helps ease the worries that many new investors might have.

Types of Bitcoin ETF

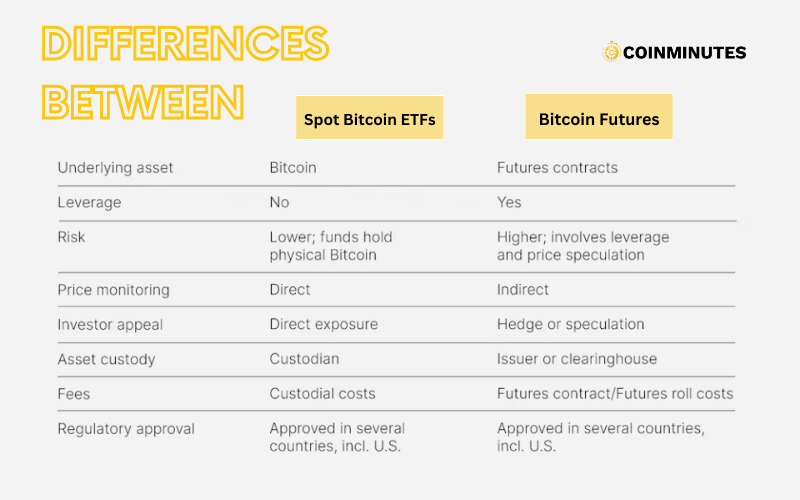

Bitcoin Spot ETF

The Bitcoin Spot ETF is an exchange-traded fund that operates similarly to other ETFs in the traditional market. Fund management companies will buy BTC, and investors can participate by purchasing shares in the ETF. These shares represent ownership rights to BTC, meaning investors indirectly own BTC without exposure to the risks associated with the crypto market. This also implies that the value of these BTC ETFs will closely track the actual value of BTC traded in the market.

While the SEC has approved many Bitcoin-related ETFs, they are primarily Bitcoin Futures ETFs. No Bitcoin Spot ETF has been allowed to trade on U.S. stock markets yet.

Recently, the SEC continued to reject the registration of Grayscale Investments to convert the Grayscale Bitcoin Trust (GBTC) into a Bitcoin Spot-based ETF. However, Bitcoin Spot ETFs are more widely accepted in other countries such as Canada and Brazil.

Some examples of Bitcoin ETFs investing in Bitcoin spot include Evolve Bitcoin ETF (EBIT), Purpose Bitcoin ETF (BTCC), Jacobi Bitcoin Exchange Traded Fund, and others.

Bitcoin Futures ETF

The SEC has consistently supported ETFs tied to Bitcoin futures contracts on the Chicago Mercantile Exchange (CME). Currently, the underlying assets in Bitcoin ETFs in the U.S. stock markets are often linked to Bitcoin futures contracts and traded on exchanges such as the New York Stock Exchange ARCA, and Nasdaq, as the SEC prefers.

A futures contract is an agreement between two parties to exchange a specific asset with standardized quality and quantity at an agreed-upon price today but with delivery at a later date in the future.

Therefore, a BTC futures contract is an agreement between two parties to exchange a unit of Bitcoin futures contract. The fund creates shares based on the current price of a futures contract unit and facilitates trading on the exchange. As a result, Bitcoin futures ETFs are backed by the price of Bitcoin in derivative markets (referencing CME’s Bitcoin Reference Rate) rather than the spot market value.

Some examples of Bitcoin Futures ETFs include ProShares Bitcoin Strategy ETF (BITO), Valkyrie Bitcoin Strategy ETF (BTF), VanEck Bitcoin Strategy ETF (XBTF), Global X Blockchain & Bitcoin Strategy ETF (BITS), ProShares Short Bitcoin ETF (BITI), and others.

How Do They Work?

Bitcoin ETFs function similarly to conventional ETFs, with a key distinction lying in their association with the performance of bitcoin futures contracts rather than conventional assets such as stocks or bonds. These ETFs invest in the underlying bitcoin futures contracts and other financial instruments tethered to bitcoin’s performance.

Bitcoin futures ETFs are traded on stock exchanges, akin to individual stocks, and their valuation is contingent on the performance of the underlying bitcoin futures contracts within their portfolio. Investors seeking exposure to bitcoin’s price fluctuations can acquire shares in a bitcoin futures ETF, mirroring the process of investing in any other ETF.

The principal advantage of bitcoin ETFs lies in their structure, providing investors with a convenient and efficient avenue to invest in Bitcoin without the necessity of directly acquiring and holding the digital currency. Professional fund managers oversee these ETFs, managing the underlying assets, including bitcoin futures contracts, and ensuring that the ETFs closely mirror the performance of bitcoin.

Pros and Cons of Investing in Bitcoin ETFs

Benefits of Bitcoin ETF

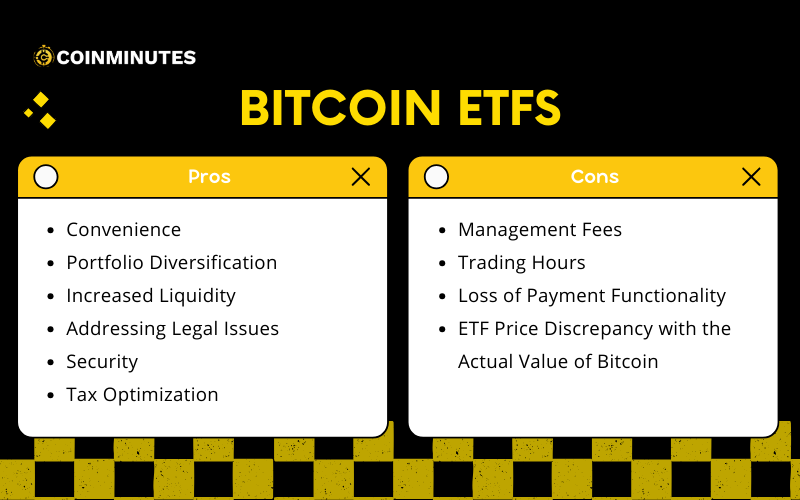

The emergence of Bitcoin ETFs has garnered attention within the crypto community for several notable advantages:

- Convenience: Bitcoin ETFs are designed to make investing in Bitcoin easy for many people who may not have an in-depth understanding of blockchain technology or want to navigate the complexities of buying Bitcoin directly on cryptocurrency exchanges.

- Portfolio Diversification: A Bitcoin ETF can include assets such as gold, Apple stocks, and more. Therefore, it shares the characteristic feature of ETFs in helping investors diversify their portfolios, mitigating risks associated with investing in a single or a small group of assets.

- Increased Liquidity: Bitcoin ETFs enable a new group of investors, potentially including institutional investors, to indirectly participate in the cryptocurrency market, thereby enhancing liquidity.

- Addressing Legal Issues: Some institutional investors, like retirement funds or asset management companies, may have regulations prohibiting direct investment in Bitcoin. However, with Bitcoin ETFs, they can gain easier access to Bitcoin without holding it directly.

- Security: For inexperienced investors in the crypto market, using a Bitcoin wallet or cryptocurrency exchanges may pose risks such as coin/token hacking, forgetting or exposing private keys, and unfamiliarity with wallet usage. Bitcoin ETFs offer a more secure alternative.

- Tax Optimization: In countries with crypto regulations like the U.S., direct investment in Bitcoin may incur higher taxes compared to trading ETFs as a type of stock on the stock market.

Risks of Bitcoin ETF

In addition to the mentioned advantages, Bitcoin ETFs also come with some drawbacks:

- Management Fees: ETFs usually charge annual management fees for the services they provide. Compared to a one-time fee (even 0%) when buying or selling on some cryptocurrency exchanges, owning shares in a Bitcoin ETF can accumulate higher management fees over time.

- Trading Hours: The crypto market operates 24/7, allowing investors to participate at any time. However, Bitcoin ETFs will only trade during the opening and closing hours of the stock market.

- Loss of Payment Functionality: While Bitcoin can be used as a means of payment in some countries, a Bitcoin ETF cannot be directly used for transactions. This means it lacks immediate payment functionality.

- ETF Price Discrepancy with the Actual Value of Bitcoin: ETFs track the prices of a managed group of underlying assets, so sometimes the ETF price may not align with the net asset value of the fund.

Who Should Invest in Bitcoin ETFs?

Choosing to invest in a Bitcoin ETF could be a favorable decision for individuals seeking a more traditional avenue to venture into the world of digital currencies, particularly Bitcoin. The process of investing directly in Bitcoin can be intricate, involving considerations about storage methods and the selection of a suitable exchange. In contrast, the utilization of Bitcoin ETFs streamlines this complexity by encapsulating crypto futures contracts within an ETF framework.

This structural approach not only simplifies the investment process for individual investors but also holds potential benefits for institutional investors. The ETF format may serve as a gateway for these larger investors to enter the cryptocurrency market with greater ease. This influx of institutional interest could contribute to sustaining a robust demand for Bitcoin in the market.

Where Do You Purchase Bitcoin ETFs?

You can find Bitcoin ETFs on various online brokers that provide traditional securities like stocks and bonds. While some of these brokers allow direct investment in Bitcoin, others only permit trading Bitcoin futures.

ETFs are traded on conventional exchanges like the New York Stock Exchange or Nasdaq. If you want a broad selection of cryptocurrencies and aim to invest directly in digital coins, you’ll need an account with a cryptocurrency exchange such as Binance or Kraken.

The Future of Bitcoin ETF

With the SEC’s approval of the first Bitcoin price-based ETFs, optimism is growing among crypto market investors regarding other ETF types currently under SEC review.

Future ETFs are likely to receive prioritized approval because the SEC has stricter oversight over the Chicago Mercantile Exchange, where futures contracts are traded.

Various entities in the U.S., such as Grayscale, VanEck, Ark 21Shares, NYDIG, Global X’s, Fidelity, First Trust, Kryptoin, and WisdomTree, have expressed a desire for the approval of Bitcoin spot ETFs. However, these proposals have either been rejected or the decision has been postponed by the SEC. The SEC’s rationale is that Bitcoin spot ETFs could lead to market manipulation and that the proposed ETFs lack proper investor protection measures.

FAQs

Is Bitcoin ETF the same as Bitcoin?

No, a Bitcoin ETF is not the same as Bitcoin itself. A Bitcoin ETF is a financial product that tracks the price of Bitcoin and allows investors to buy and sell shares of the ETF on traditional stock exchanges. It provides a way for investors to gain exposure to the price movements of Bitcoin without directly owning the cryptocurrency. On the other hand, Bitcoin is a decentralized digital currency that exists on a blockchain. It can be bought, sold, and used as a medium of exchange. When you own Bitcoin, you possess the actual cryptocurrency, whereas owning shares in a Bitcoin ETF means you have a stake in a fund that holds Bitcoin.

Are Bitcoin ETFs a good investment?

Opting for futures-based ETFs is a wise decision for those looking to make a long-term investment in Bitcoin. Before diving into ETF investments, traders must weigh factors such as potential deviations from net asset value, fund fees, and roll expenses.

Are Bitcoin ETFs regulated?

In the U.S., all ETFs that you can trade on the stock market follow rules set by the Securities and Exchange Commission (SEC). Now, when it comes to Bitcoin ETFs, they keep an eye on Bitcoin futures contracts, and those are watched over by the Commodity Futures Trading Commission (CFTC). However, the ETFs that directly follow the price of Bitcoin (Spot Bitcoin ETFs) don’t have rules from the SEC or CFTC.

Conclusion

The Bitcoin ETF marks a significant stride in bringing crypto assets to traditional investors and advancing the mainstream acceptance of cryptocurrencies. However, Bitcoin ETFs are still in their early stages and come with their own set of risks and inconveniences. It is conceivable that in the future, we will witness further expansion in the Bitcoin ETF market, both in terms of quantity and characteristics.